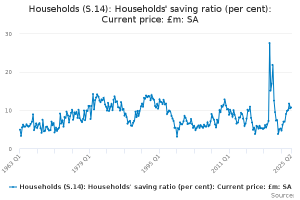

The real short-term problem for the chancellor ahead of next month’s budget is that we are not spending enough. The household savings ratio has increased sharply since the post-pandemic spending sugar rush.

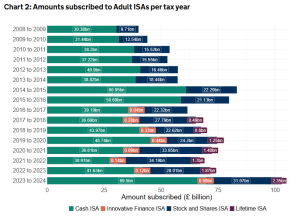

Last year was also a record year for ISAs with over £100bn subscribed.

Some of the underlying drivers of household spending are also showing weakness. The housing market drives a significant portion of household spending and is currently showing signs of weakness. Demographics may also be driving this reduction in spending, as we age, we tend to spend less and save more. Fewer births also have an impact. Households will tend to be large net spenders and borrowers when starting a family.

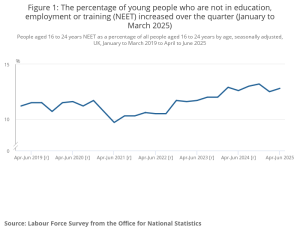

Youth employment is a significant issue. Young people entering the workplace tend to start spending and borrowing. The number of young people not in education or employment is a major concern.

This lack of spending also highlights the significant impact of consumer psychology on the economy. If people are not confident about the future prospects for the economy, they tend not to spend. Concerns about inflation and tax rises no doubt play into this. A reluctance to spend on big-ticket items and a general “cutting back”.

This problem for the chancellor is compounded by the fact that she can’t increase borrowing to raise government spending and provide a psychological kick-start to the economy.

Do we need significant reform to the way we save and invest in the UK?

Is the way we save part of the fundamental problem in the UK? Money saved in ISAs tends to be invested in cash or low-risk investments, discouraging more high-risk business and startup investments. The same with pension investments. The trouble with these investments is that the main “return” is the tax savings, and any further return on investment is a secondary consideration.

Increasing IHT on pensions was a response to wealthier people stuffing their pension pots and leaving them there to avoid IHT. There has also been noise around the reform of ISAs. Discussion of a “Brit ISA” that would channel funds into UK investments has been dropped as it was seen as unworkable. There is a chance we might see some reform to Lifetime ISAs in the upcoming budget.

In the US, rules regarding the use of 401(k) funds to invest in your own business or startups are far more relaxed, with rollover relief that allows you to use your retirement savings to start a business without incurring withdrawal penalties. Encouraging entrepreneurial risk-taking has been an area where we have consistently struggled in the UK.

What Would I Do?

Along with reform to current tax savings wrappers to allow more risk-taking, the one thing I would do is enable collective pension funds to invest a proportion of their funds in new residential property. Rental income is an actuary’s dream as it tends to keep pace with inflation.

We know housing is a major issue in the UK. We also know that people are not saving enough for their retirement.

Increasing housebuilding is the most obvious way that the government can kick-start the economy.

Putting all these together, the obvious answer is to change the rules to allow large pension funds to invest in building new houses and to permit pension funds to use leverage, effectively becoming long-term landlords. This would tick a number of boxes.

The reason the government may not want to do this is that governments typically want pension funds to invest in government bonds, which helps keep government borrowing costs down. That horse has already bolted.

Without some bold reforms to savings that kick-start spending and investment, it is difficult to see how the government can drag the economy out of its current rut in the short term.